How Data-Driven Segmentation Shapes A Utility's Strategy and Operations

Striking a balance between personalization and scalability in customer engagement

Posted From: Nags Head, North Carolina, United States

Customer Energy Series: Article #2

Topics covered:

Customers and their classes, revisited

Segmentation, its value, and its potential costs

Two case studies: utility and customer segmentations

From Ratepayer to Customer

In the last article, we explored how energy powers our world. From the food we eat, the way we travel, and the climate-controlled spaces we occupy, a “customer” is paying for the energy to make it all happen.

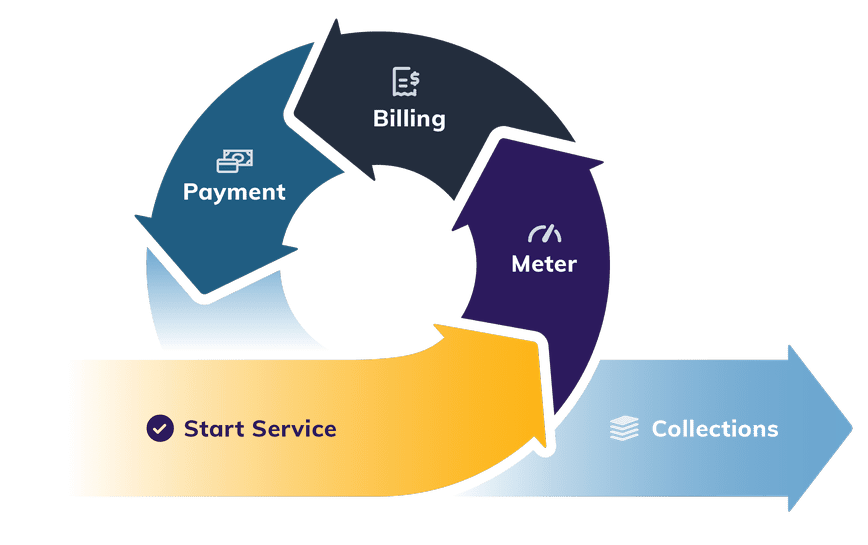

Like any business, a utility must be compensated for the services it provides its customers. For utilities, this is known as "meter-to-cash". Historically, utilities referred to customers as "meters" or "ratepayers", both terms terms rooted in a bygone era dominated by regulatory concepts.

Today, these customers are called what any other industry calls their customers - customers! Viewing and treating people paying the bill simply as receivers of regulatory-enabled costs is antiquated. Now, utilities attempt to optimize their customer relationships in ways that benefit both themselves and their customers. For utilities, an optimized customer relationship can be one that sufficiently meets customer needs while minimizing costs, such as any accounts receivable from customers.1 Enhancing the overall customer experience improves the ability and willingness of customers to pay for outstanding energy expenses, thereby reducing customers’ arrears.

Customer classes, revisited

The last article briefly explored that utilities classify customers by their energy (kWh) and power use (kW). We used ConEd as the example, where their four customer classes all exhibit vastly different average energy use across the year. This analysis rested on averages: we looked at the four classes’ as an average of their total energy use over the course of the year. For residential customers, this is the total energy use of all residential customers divided by the number of accounts on ConEd's EL1 rate. This exercise gives us a general idea about the entire set of residential customers as a whole (all 3.4M of them) but it does not give an idea about the nuances of each residential customer, or even a subset of residential customers.

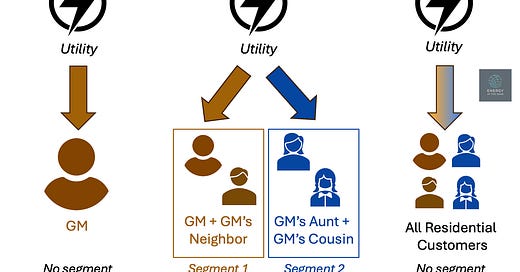

My needs as a residential customer differ from my aunt's in the Bronx and differ from a penthouse apartment on Billionaire's Row, even though we are all on the same EL1 rate.

Meeting the unique needs of customers, even those within the same class, will enhance the "customer experience" (CX) of those customers. Instead of being viewed and treated simply based on their rate class, customers are catered to based on their unique needs.

Segmentation, the shortcut to understanding customers

A utility can cater to customers in a variety of relationships. The spectrum of relationships can oscillate between one-to-one (i.e., each customer is treated uniquely) to one-to-many (i.e., one rate class treated the same). In between, there is a one-to-few relationship, where rate classes can be divided to more specific segments, but not to the individual levels. This is called customer segmentation. Segmentation is a cost-effective solution that allows utilities to cater to the unique needs of a customer without having to cater specifically to each individual customer.

How do utilities segment? Why is this valuable?

Data is the engine that drives the ability for utilities to segment their customers. Utilities have a whole host of data inputs that allow for segmentation. Customer Information System (CIS), Advanced Metering Infrastructure (AMI), Customer Relationship Management Systems (CRM), Outage Management Systems (OMS) and Distributed Energy Resource Management Systems (DERMS) are a handful of systems that utilities likely have within their technology stack that can provide insight into their customers. Add digital marketing tools and surveys, and utilities have a fairly comprehensive view of the customer that other industries likely dream of.2

With this data centralized, utilities can use segmentation to better understand and cater to their customers' needs.

The general process is as follows:

For instance, one utility launched a new product to customers. Before launching, they combined their AMI data with a survey they conducted for this new product. They then analyzed this combined data set using data science methods, like K-means clustering and hierarchical clustering, to derive segment their customers.3 Furthermore, they personified these segments for that product's marketing campaign. The product launched with a marketing campaign that signed up more customers with less budget spend due to a much higher conversion rate of interested applicants, illustrating the effectiveness of segmentation to improve the CX.4

Related, a utility can combine their CIS, AMI, and CRM data to segment their customers based on their billing history, usage patterns, and interactions with the utility. Taken together, this combined dataset allows for the utility to appropriately segment and personify their customers within a rate class. The end result could be a utility who classifies their residential customers across five different personas, each with different billing, usage, and customer support tendencies.

Segmentation allows utilities to:

Tailor marketing to customers: Promote budget billing programs to customers that are identified as having a higher likelihood of falling into arrears OR market complementary products and services to homeowners (e.g., a new heat pump was just installed, would they also like to participate in HVAC-based demand response?)

Improve the CX: Provide information on new energy experiences (e.g., sending solar "how-to" material to only customers identified as having solar)

Optimize utility resource allocation: Align local grid constraints with potential load shifting program estimates (e.g., a neighborhood has minimal WFH customers, so they do not need AC during peak, grid congested hours, and the utility can defer substation upgrades if those customers sign up for demand response)

Inform future strategic decisions: Determine what future products and services could be developed to best serve customer needs

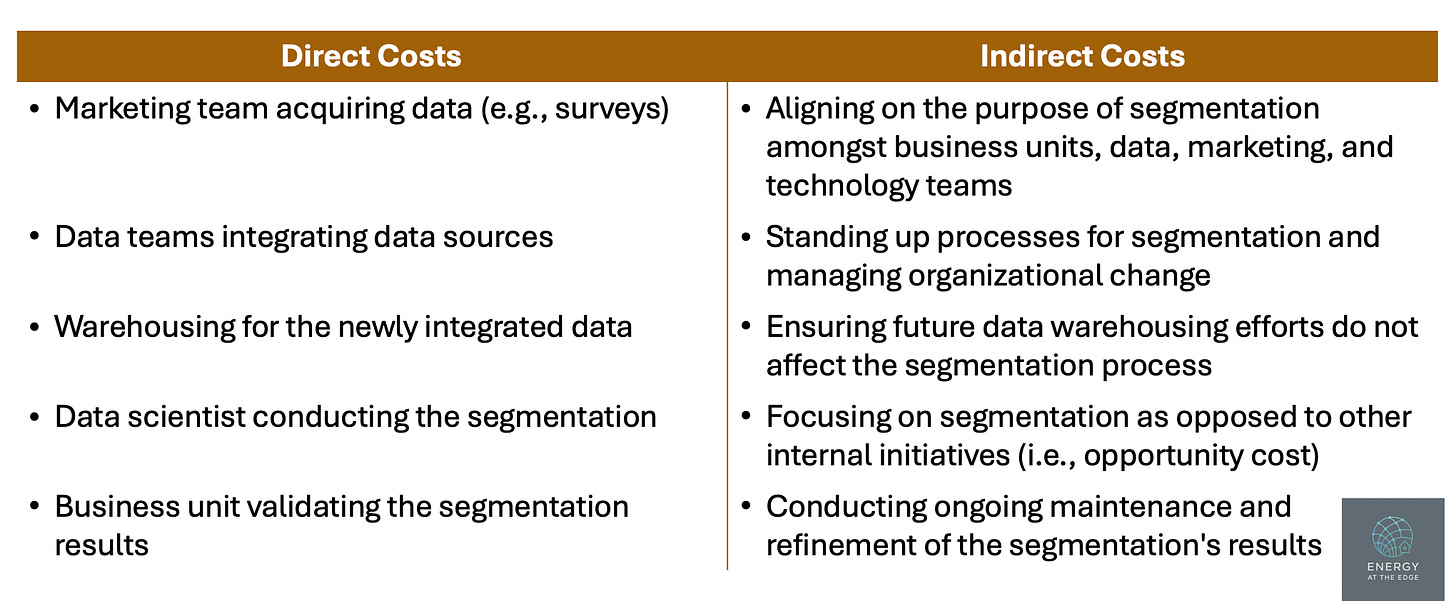

What's the catch? The direct and indirect costs to segmentation

In the three examples illustrated above regarding how segmentation is employed at utilities, there are costs associated with the benefits. The costs are both directly and indirectly attributed to segmentation.

Direct costs are easier to see and measure, while indirect costs include hidden time inputs, both for completing the work and preparation in meetings. Both sets of costs must be accounted for when a utility evaluates the cost effectiveness of investing in segmentation strategies.

Case study: ConEd’s Customer-Viewable Segementation

ConEd conducts a publicly viewable segmentation for residential customers. The image below shows how ConEd segments residential customers into either "efficient similar homes" or "similar homes". Segmentation is based on location, building type, and energy use.5

This segmentation serves a dual-purpose. First, it creates awareness in my energy consumption habits - how efficient am I compared to my peers? Second, it allows ConEd to target homes based on their aforementioned characteristics - if I am already really efficient, I could be an energy conscious user more apt to trying their new products and services.

While segmentation does not allow a utility to offer a completely custom, "one-to-one" treatment of all their customers, the "one-to-few" approach allows utilities to better understand and reasonably serve its customers.6

Case study: How engaged are residential customers with energy?

In late 2022, a global consultancy published a comprehensive segmentation focused on residential customers' engagement with energy. Based on survey results from tens of thousands of people from across the globe, the findings showed five segments of residential customers. The segmentation relied on questions related to customers’ engagement with energy, along with demographic questions such as age, work location, and gender. The five segments - Champion, Enthusiast, Ally, Novice, and Bystander - each differed based on their level of engagement with energy. Based on this engagement-based segmentation, the findings showed each segment took different actions related to their energy interactions. For example, the Champion adopted clean and efficient energy options much more frequently than a Novice.

Even though this segmentation is not based on a utility's propriety dataset, it still provides a valuable view of how aware, engaged, and confident customers are with energy. This research can inform how a utility engages with its customers.

Takeaways

As utilities evolve from treating customers simply as ratepayers, segmentation emerges as a practical, data-driven strategy.

Segmentation allows utilities to make smarter, more targeted decisions to enhance customer experiences and optimize utility resources.

A utility must determine when the benefits of implementation outweigh the costs.

In the next post, we will explore how segmentation allows utilities to more effectively cater to a customer's energy journey.

This is post #3 on Energy at the Edge.

Views expressed in this article are those of the author and do not necessarily represent the views of their place of employment.

AI was only used for the creation of certain graphics, not for writing.

Special thanks to Adam C and Ana M for proofreading.

"Arrears" is the term for customers who have not paid their past utility bills in full. In my home state of New York, 1 in 8 customers were in arrears with a total outstanding balance of $1.8 billion. (source)

Increased access to data allows them to make more informed decisions that benefit both the customers and themselves.

K-means and hierarchical clustering are two data science-based methods to segment customers based on similar characteristics.

Customers who were deemed likely to be interested in the product, based on various characteristics, received marketing messages, as opposed to all customers: customers received information that was relevant to their needs.

Within 0.6 miles, apartments/condos, and 20% lowest users of energy for such characteristics.

A utility could attempt to understand the complete needs of each customer, however, it is likely too cumbersome and costly to action on each customer's unique needs. Thus, a more cost effective method to optimize CX is to group the residential class into a few segments ("one-to-few") where the vast majority of their needs are accurately captured and catered to.