From Assumption to Hypothesis: A Forecasting Approach to Energy Futures

A structured disclosure of my assumptions, from high conviction to coin flips, about the future of energy systems.

This is article #1 in the reflections series.

Posted From: Lexington, Kentucky, United States

Assumption Disclosure: My Forecasting Framework

One of the leading researchers on decision-making and behavioral economics, Daniel Kahneman, established that humans consistently make assumptions in life for cognitiative efficiency; whether we realize them outright or not.

This post is all about indirectly disclosing assumptions I make about the energy transition, by disclosing my hypotheses about the future.

What do I believe is highly certain?

What do I believe is highly uncertain?

Disclosing these hypotheses allows me to clarify my thoughts, and likewise future writing, regarding complex topics.

Are my hypotheses and assumptions incorrect from the start or, does the situation change as time passes?

What likely futures and how do these futures occurring impact other futures?

Ensuing posts will likely explore beliefs that are somewhat contested (i.e., ones I have low certainty or I am totally uncertainty about). Clearly outlining my current beliefs will allow me to dive deeper into topics I am unsure about, with the hopes of refining my hypothesis to either more or less certainty about the future.

This process is inspired by reading books on forecasting and human behavior (Thinking Fast and Slow, Superforecasting, Thinking in Bets). I came to this specific idea as I was recently on a plane reading Aaron Siegle's "Data Center as a Power Plant" paper; Aaron creates a logic-based argument of recommendations after clearly stating out assumptions about future activity regarding data centers and energy use. It is a prime example of this scientific-method-based approach applied to hypothesis-making and future research.

The exact methodology I have taken is straight-forward:

How confident am I in the statement provided?

The scale is only positive; if I do not believe in a hypothesis, then I believe in its "null hypothesis." Each statement must be similar to well-intentioned goals (set through a "SMART" framework - with a focus on specific, measurable, timebound.)

Another way to phrase my confidence: How would I feel betting on the statement?1

Which of the below statements do you disagree with most? Let me know so we can discuss it when we talk next!

High Confidence

"I will feel bad for the counterparty taking this bet"

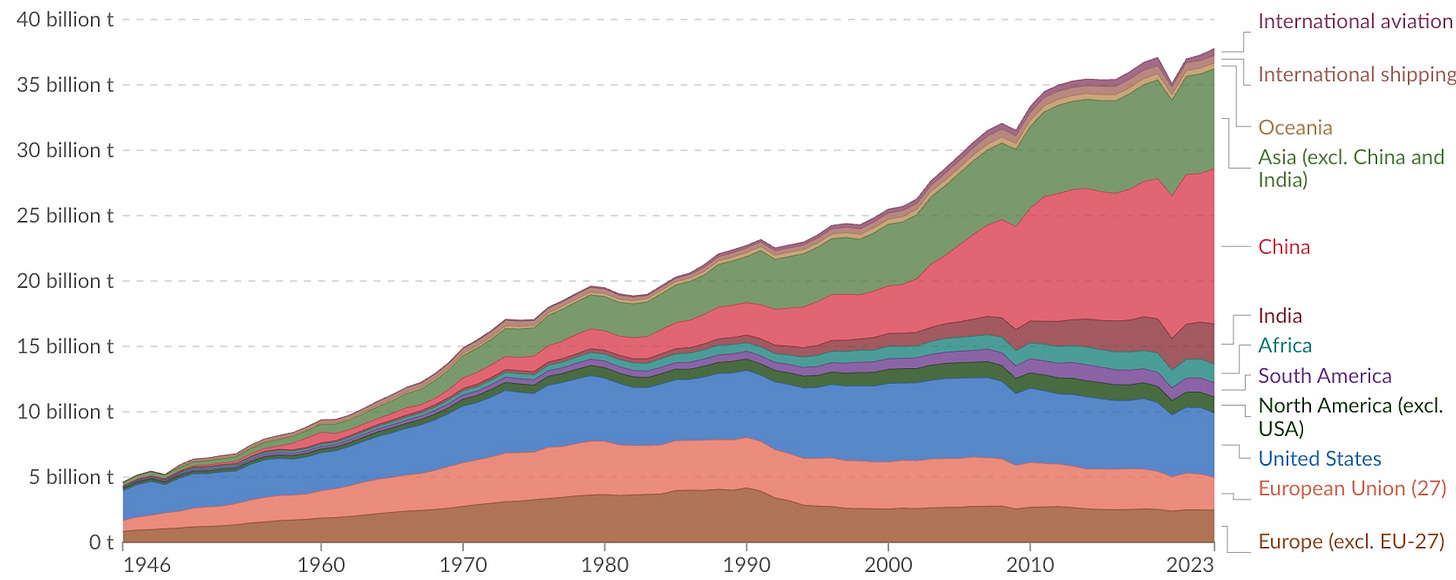

Global emissions rise through 2030

Energy demand will rise in the World and the US through 2050

Net Zero will not be reached by mid-century by any G20 country2

Each DER (distributed energy resource) technology (e.g., customer-sited batteries, small-scale solar, controllable EVs, ACs, & water heaters) will continue to proliferate at double-digit growth rates through 2035 (i.e., at least a 159% increase of these DERs).3

To explore in a future article: If realistic gains towards decreasing emissions are to be achieved, altering customer demand must be a part of utility planning (i.e., demand response, energy efficiency, virtual power plants must increase their share and importance within integrated resource plans -

"IRPs”)

VPPs (Virtual Power Plants) will evolve from a term that captures all customer-demand programs to a term that focuses on grid operations.

Bonus prediction: VPPs will become a core part of electric utility operations by 2035.

Medium Confidence

"I got a good shot, so I’d put some chips on it, just not go all in."

Global emissions will keep rising until 2035

Even as wind and solar rise to 15% of the world's energy; they are currently at 5.6%

Lithium-ion battery cost curves in China will decrease through 2030

Bonus: China will lead the export of vehicles (by $) by 2030; China is currently a distant third globally, as the leader (Germany) has 3x as many export sales.

Long-duration energy storage will become a listed component of many US utility IRPs by 2035

The defining feature of US PUCs (public utility commissions) will be either supporting investments in grid modernization efforts (e.g., AMI 2.0) OR customer affordability (i.e., keeping customer cost increases below inflation)

Bonus: Gas price volatility's affect on power generation (i.e., fuel cost line-item) will become a central theme of arguments by consumer advocates against the buildout of more gas turbines

Low Confidence

"I'd like to make it interesting"

Global emissions will keep rising until 2050

US's EV (electric vehicle) sales will stall at 30% of new vehicle sales until a major advancement in battery chemistry or charging times; current BEV + PHEV (plug-in electric vehicle) sales are ~11%.

Data center demand in the US will increase at current consensus levels (18-27% / year) through 2028, and then, demand growth will come below current consensus levels for the few years after

A few PUCs will provide full-fledged support for VPPs, such as market structure changes, financial incentives (e.g., rate design, cost recovery through shared savings), and data access reforms

Totally Uncertain

"I'd rather bet on coin flips"4

Data centers will make customer-demand side management programs a part of their business operations

Bonus: Hyperscalers (e.g., Amazon, Microsoft, Google) will not be able to achieve 24/7 carbon-free electricity

Utilities will suffer a decrease in performance with outage metrics (e.g., SAIDI, SAIFI, CAIDI).

Residential rate structures based on time-varying rates (e.g., time-of-use, critical peak pricing, real-time rates) will NOT be adopted by the majority of consumers; instead, subscription-based rates will (i.e., paying for services, not for energy).

Components of the IRA that incentivize clean energy deployment through tax credits will not get repealed5

Lithium-ion battery cost curves in the US will increase, not decrease

Forecasting the future is not about being right; it is about being clear. By openly stating my assumptions and confidence levels, I can better refine my thinking over time and invite productive disagreement along the way.

This is post #1

Views expressed in this article are those of the author and do not necessarily represent the views of their place of employment.

I do not make any bets outside of trivial activity-based bets with friends — no sports betting, casinos, or triple-dog-dares — only the occasional "winner picks the lunch spot type bets".

10% CAGR for 10 years is a 159% increase - this is the minimum increase for all technologies listed

These hypotheses are all within the next five years (i.e., by 2030).

Love this idea and excited to read more! Some initial responses that came to my mind are below.

1. "Energy demand will rise in the World and the US through 2050"

I'm skeptical that US energy demand will rise all the way through 2050, or at least wouldn't place it in the High Confidence category. On a total energy basis, the replacement of technologies with more energy efficient technologies (ICE to BEV) may be even more impactful than the energy efficiency improvements of given technologies.

2. "Data center demand in the US will increase at current consensus levels (18-27% / year) through 2028, and then, demand growth will come below current consensus levels for the few years after."

I agree with this one in particular and think you could even bump it up on a bit in certainty!

3. "Residential rate structures based on time-varying rates (e.g., time-of-use, critical peak pricing, real-time rates) will NOT be adopted by the majority of consumers; instead, subscription-based rates will (i.e., paying for services, not for energy)."

I think I probably agree with you on this one. To me, the more interesting questions are a) will a majority of consumers even have access to time-varying rates? b) will time-varying rates actually prove to reduce costs and carbon emissions and do so in an equitable way (i.e., not just energy nerds with Nests and people who can afford Smart Home and energy management applications reducing their costs while the utility's costs are still recouped from other consumers? and c) how do we encourage both PUCs/utilities to launch time-varying rates and consumers to adopt them?

"Net Zero will not be reached by mid-century by any G20 country"

1. I don’t believe that it’s the responsibility of any specific nation or block of nations to achieve (this isn’t what you’re saying but I’m getting the implication that you think this should be a priority for the G20, correct me if I’m wrong). It's too big of a problem to leave to governments.

2. I was going to ask why are you making a correlation between the global emissions and the energy sector, if the purpose is to forecast the future energy industry but I understand that energy is the largest contributor of emissions.

3. If I were na Energy Sector leader and responsible for generating, transmitting and securing the energy infrastructure for my customers (large or small) I would be primarily concerned with the quality of my service however I understand that for a time these leaders may not have been aware of the consequences of the decisions that were made in the pursuit of energy growth and the adoption of ESG as a concern has led to energy and environmental impact as a important area of discussion

"G20 countries currently account for 81% of the world's emissions (2021)."

4. This makes it seem as if 20% of the world is creating 80% of the emissions which is accurate at the national level but when you consider that G20 nations represent more than two-thirds of the world's population then really you’re just saying “most of the world creates most of the pollution”. The original statistic hides this information and causes people to focus on the wrong problem.

**I could be totally wrong in my thoughts so take everything with a grain of salt** otherwise I love the topic and appreciate the discourse you've created.